The 5 C's That Almost Ruined Banking, Part 1

It has been over 10 years since the end of the Great Recession which saw unemployment double to 10% and the Dow Jones Industrial Index had declined 53.8% by March of 2009. With the impact that COVID-19 has had on our country and economy, I’ve been reminded of those days. While I remain hopeful of a speedy economic recovery and a return to our strong pre-pandemic levels, it’s important for us to remember sound business financial principals so we don’t repeat the same mistakes.

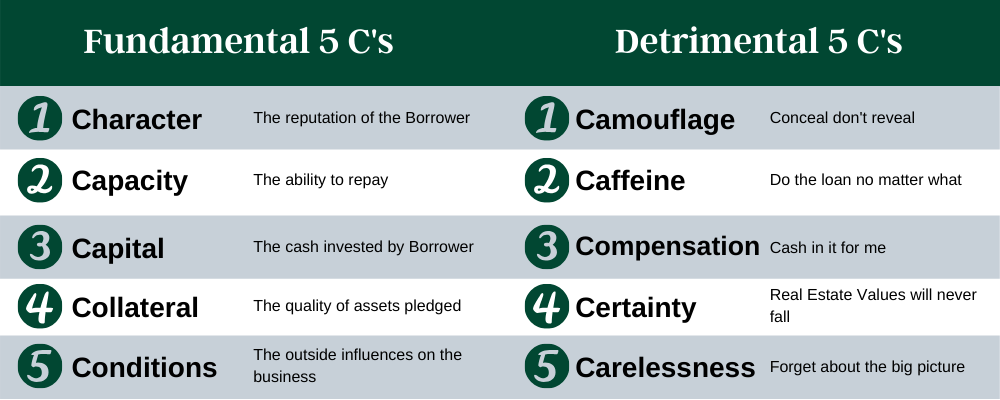

I was taught early in my banking career to apply a tool called the “5 C’s of Credit” when making a loan decision. This tool considers all the factors that could affect the performance of the loan. This tool served the banking industry very well for many years; however, somewhere along the way some banks began substituting new “C” words for the fundamental ones. As a result, the banking system went through major changes in how we are structured, capitalized and regulated. Here is a comparison of the “Fundamental 5 C’s” to the ones I call the “Detrimental 5 C’s” and the affect they had on our industry.

Character vs Camouflage

The first fundamental C-word is “Character.” Character is the intangible that separates borrowers who pay as long as they WILL (meaning as long as they can) from those who pay UNTIL (meaning to the end). Character is not a promise of future behavior, but rather is an established reputation based on the actions of the past. That’s why it is so important that we get to know our borrower. Are they trustworthy? Do they pay their personal debts on time? Are they reliable?

Unfortunately, Character was replaced with “Camouflage.” Camouflage means to conceal or keep something hidden. In the years leading to the Great Recession, many banks may have intentionally overlooked red flags that later became surrender flags when problems were encountered. Camouflage can partly be blamed on technology. Borrowers can also conceal or manipulate information to get what they "want" rather than what they need or can even handle. Since many loan decisions are automated based on input data, we saw “garbage in => garbage out.” This was a significant contributing factor to the Great Recession.

As a community bank, one of our greatest competitive advantages is how well we get to know our customers. We want to truly understand your business, your personal goals and dreams, and work together in making them a reality. One of our core values is honesty. We expect our customers to be honest with us and we will always be honest with you - which sometimes means telling you things you don't want to hear. When we both act with good character, we build a lasting relationship that benefits all involved.

If you are already a bank customer, thank you for your loyalty and please let us know of any ways we can help. For those looking for a trusted banking partner, we'd love the opportunity to earn your business.